How Digital Banking Apps Are Changing Money Management In Dubai

Digital banking in Dubai has stopped being just a convenient addition to traditional services. Today, mobile apps are the main tool that city residents use to manage their finances. They allow you to control accounts, make transfers, pay for purchases, and even quickly issue a credit card online at any time of the day without visiting the office.

The high smartphone penetration rate (over 97% of UAE residents) has become the foundation for the rapid growth of digital services. According to research data, the revenues of the fintech sector in the period 2022-2028 are increasing almost three times faster than those of classical banking. And the volume of investments in fintech in 2024 exceeded $2.5 billion, which confirms the seriousness of this trend.

Convenience and Personalization

Users appreciate that digital banking is available 24/7. In the app, you can check your balance, set up a regular payment, send an instant transfer, or use analytical tools to control expenses. Push notifications and real-time updates help keep all transactions under control.

Modern technologies make services more personalized. Artificial intelligence and machine learning analyze user habits and tell us where to cut costs, how to allocate the budget more profitably, or what savings are available.

Separately, it is worth mentioning the products with a refund. Cash back credit card offers are becoming especially popular among young people. They not only make shopping more profitable, but also often include bonuses, discounts, and special promotions.

Security and Trust

With the increasing number of online transactions, the issue of security is becoming a key one. Banks in Dubai are actively implementing multi-factor authentication, biometric identification and data encryption. The average cost of information leakage in the financial sector in 2024 was $6.08 million, which explains the increased attention to data protection.

It is important for clients that security is combined with favorable conditions. Therefore, many choose products like the best cashback credit card in UAE, which combine a high level of protection with transparent and attractive offers.

New Financial Habits

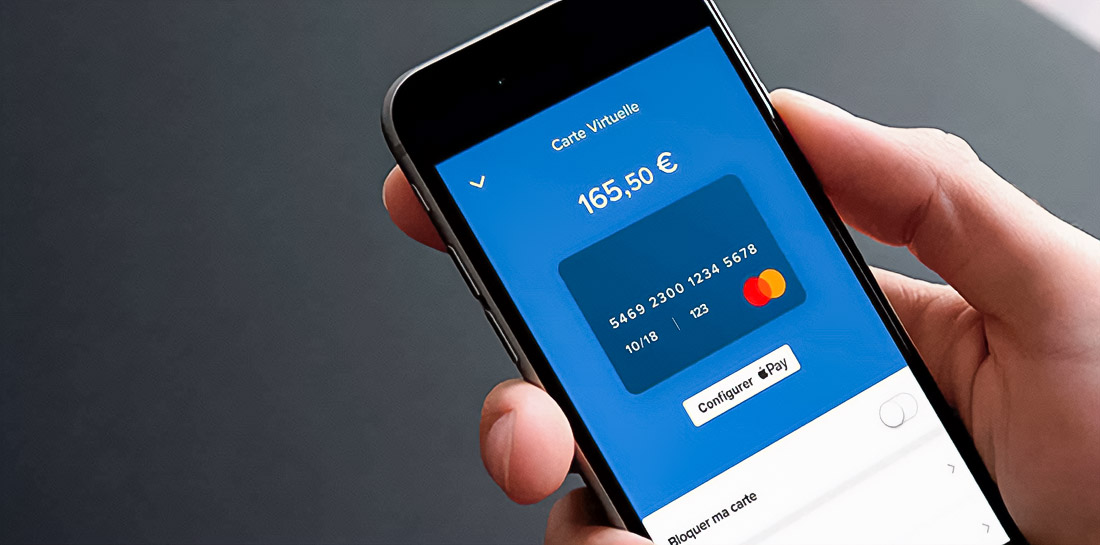

Millennials and Generation Z increasingly prefer digital wallets and virtual cards. The projected volume of virtual card transactions will reach $6.8 trillion by 2026.

The Buy Now, Pay Later (BNPL) model is also gaining popularity. It allows you to allocate expenses without a classic loan and attracts the younger generation with its flexibility. In the United States alone, $7.3 billion was spent on Black Friday through BNPL, and similar solutions are being actively implemented in the UAE.

Equally in demand are services that enable you to apply a credit card online and choose the best deals like best credit card in Dubai with bonus programs and additional options.

Financial Inclusion and Business Support

Digital banking expands access to services, especially for residents of remote regions where there may not be branches. Mobile services allow you to transfer funds, save money and open up new opportunities for financial management.

This is an even more important tool for business. More than 90% of companies in the UAE are small and medium-sized enterprises. For them, digital banking means speed and savings. Online account opening, international transfers, and instant payments help you work more efficiently. Additionally, companies use bank credit cards to manage working capital and optimize costs.

Innovation and The Future

The future of banking services in Dubai is directly related to technology. Blockchain, decentralized systems, and open banking models will be actively implemented in the coming years. The Central Bank is launching the Digital Dirham project, a national digital currency that will simplify international settlements and reduce fees.

Biometric authentication, investment platforms with elements of robo-advisors, and the development of mobile banking UAE services are becoming part of the new financial ecosystem. In parallel, banks will offer products with favorable terms, from credit cards with rewards to various credit card offers in UAE.

Conclusion

Digital banking applications in Dubai have become the main channel of customer interaction with financial institutions. Convenience, high security, personalization and a variety of credit card offers have made them an integral part of everyday life.

The fintech sector is growing three times faster than traditional banking, and initiatives such as Digital Dirham are opening up new perspectives. All this confirms that the future of money management in Dubai has already arrived, and it belongs to digital banking.

Baseball fan, foodie, record lover, Eames fan and storyteller. Producing at the crossroads of beauty and purpose to craft meaningful ideas that endure. German award-winning designer raised in Austria & currently living in New York City.